The real estate market in South Carolina has been steadily evolving over the years, responding to shifting dynamics and changing preferences of homebuyers. One notable trend gaining substantial popularity in recent times is the concept of rent to own homes.

This innovative approach to homeownership offers a unique solution for both buyers and sellers in the Palmetto State. In this comprehensive market analysis, we will delve into the nuanced world of rent to own homes in South Carolina, exploring the benefits, challenges, and key insights from a real estate industry perspective.

Understanding Rent to Own Homes

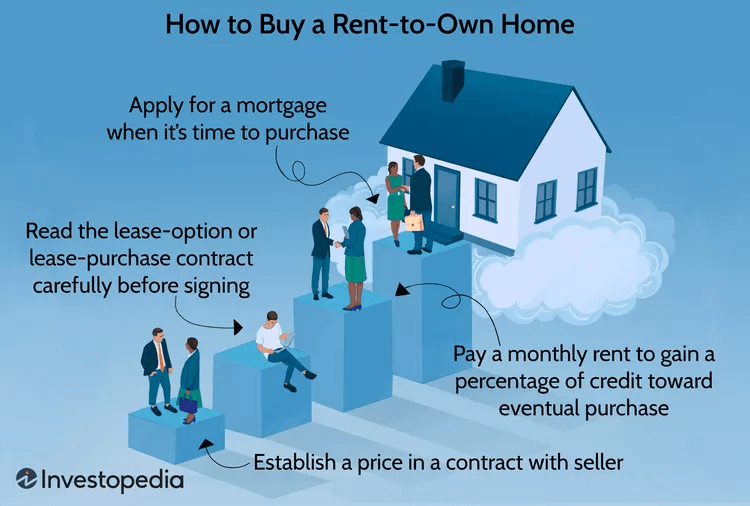

Rent to own, often referred to as a lease option or lease purchase agreement, is a real estate arrangement that allows tenants to rent a property with the enticing option to purchase it at a predetermined price after a specific period, which typically spans from 1 to 3 years.

This arrangement is particularly appealing for those who may not be fully prepared for immediate homeownership but aspire to own a home in the future, taking a strategic and patient approach to achieving their homeownership dreams.

Benefits of Rent to Own Homes

Path to Homeownership

Rent to own agreements offer prospective buyers a gradual and well-structured path toward homeownership.

They can reside in the property they eventually intend to purchase while simultaneously saving for a substantial down payment and working to improve their credit scores.

Locking in a Price

One of the standout advantages of the rent to own model is that buyers have the unique opportunity to secure a property at today’s price, effectively protecting themselves from potential future market price increases, a factor that could significantly impact traditional homebuyers.

Test Drive

Renters opting for a rent to own arrangement can essentially “test drive” the property and its surrounding neighborhood, ensuring that it truly meets their long-term needs and preferences. This eliminates any buyer’s remorse that can often accompany a rushed home purchase.

Challenges and Considerations

Higher Monthly Payments

It’s important to note that rent to own properties often come with slightly higher monthly rental payments compared to traditional rental agreements.

This is because a portion of the rent is set aside and credited toward the future purchase price, allowing renters to accumulate savings over time.

Complex Agreements

The contracts associated with rent to own homes can be complex and may require legal assistance to understand fully.

It’s crucial for both parties, the landlord-seller, and the tenant-buyer, to have a clear understanding of their respective rights and responsibilities outlined in the agreement.

Loving this special home but wondering if it’s good to invest in it. deciding about the house, read this important things to know Before Investing.

Market Fluctuations

As with any real estate investment, there are inherent risks involved. Buyers opting for rent to own homes may face potential risks if the market value of the property decreases during the rental period. However, this is a risk that can be mitigated through careful market analysis and professional advice.

South Carolina’s Rent to Own Market

South Carolina, known for its diverse geography and vibrant communities, offers a real estate market that is as varied as its landscape.

The popularity of rent to own homes varies across different regions of the state, with each area presenting unique opportunities and challenges.

Upstate South Carolina

In the upstate region of South Carolina, cities such as Greenville and Spartanburg have witnessed a notable surge in the availability of rent to own properties.

The stable job market, robust economy, and a growing number of industries make this region particularly attractive for both buyers and sellers interested in the rent to own model.

Lowcountry and Coastal Areas

The Lowcountry and coastal areas of South Carolina hold a distinct allure when it comes to rent to own homes.

Here, The concept is particularly appealing for those considering to buy a condo in Myrtle Beach, especially for those seeking a second home or a vacation property with stunning waterfront views

The combination of natural beauty and the prospect of future ownership makes this region unique in its approach to rent to own agreements.

Midlands and Inland Areas

The Midlands and inland areas of South Carolina offer a balanced mix of urban and suburban options for rent to own homes.

Columbia, the state’s capital, has experienced a growing interest in this housing arrangement, driven by its expanding population and the presence of educational institutions.

Market Trends and Predictions

Looking ahead, several noteworthy trends are shaping the rent to own market in South Carolina:

Increased Demand

Industry experts anticipate a rising demand for rent to own homes in the state. As more potential buyers seek flexible homeownership solutions, the rent to own model is poised to meet their needs.

Digitalization

Technology continues to play a pivotal role in streamlining the rent to own process. Online platforms and tools are making it easier than ever for both buyers and sellers to navigate agreements digitally, enhancing convenience and accessibility.

Affordability Concerns

While South Carolina has historically been known for its affordability, rising property prices may prompt more individuals to explore rent to own options as a strategic means to secure their place in the state’s real estate market.

Also Read, Tips for First Time Home Buyers

Tips for Success in Rent to Own

For those considering rent to own in South Carolina, here are some valuable tips to ensure a smooth and successful experience:

Thoroughly Review Contracts

Seek legal counsel to thoroughly review all terms and conditions outlined in the rent to own contract. Clear and transparent communication between both parties is essential for a mutually beneficial arrangement.

Financial Preparedness

Adequate financial planning is crucial. During the rental period, work diligently to improve your credit score and accumulate savings to secure a favorable mortgage rate when it’s time to exercise the purchase option.

Property Inspection

Before committing to a rent to own agreement, conduct a comprehensive inspection of the property. Identifying any necessary repairs or maintenance early on can save you time and resources down the line.

Also Read, Common Questions to Ask When Applying for a Home Loan

Conclusion

Rent to own homes in South Carolina represent a promising and flexible path to homeownership, allowing individuals to bridge the gap between renting and buying. While it comes with its set of challenges, the numerous benefits and flexibility it provides make it a compelling option in the state’s diverse real estate market.

As South Carolina’s real estate landscape continues to evolve, rent to own remains a significant player, catering to a wide range of housing needs and aspirations.

Whether you’re a prospective buyer or a savvy seller, understanding the dynamics of this market can empower you to make well-informed decisions and unlock exciting opportunities in the dynamic world of real estate in the Palmetto State.